Fascination About Commercial Insurance In Dallas Tx

Wiki Article

Health Insurance In Dallas Tx Things To Know Before You Get This

Table of ContentsInsurance Agency In Dallas Tx for DummiesEverything about Health Insurance In Dallas TxThe Ultimate Guide To Life Insurance In Dallas TxThe Only Guide to Truck Insurance In Dallas Tx

There are many various insurance coverage policies, as well as recognizing which is right for you can be challenging. This overview will review the various types of insurance policy and also what they cover.It can cover regular checkups along with unexpected ailments or injuries. Traveling insurance coverage is a plan that supplies financial defense while you are taking a trip. It can cover trip terminations, lost luggage, clinical emergencies, as well as various other travel-related costs. Travel medical insurance coverage is a policy that especially covers clinical expenses while traveling abroad. If you have any concerns about insurance policy, contact us and ask for a quote. They can help you pick the ideal policy for your demands. Many thanks for reviewing! We hope this overview has actually been handy. Contact us today if you want personalized service from a certified insurance agent. Cost free.

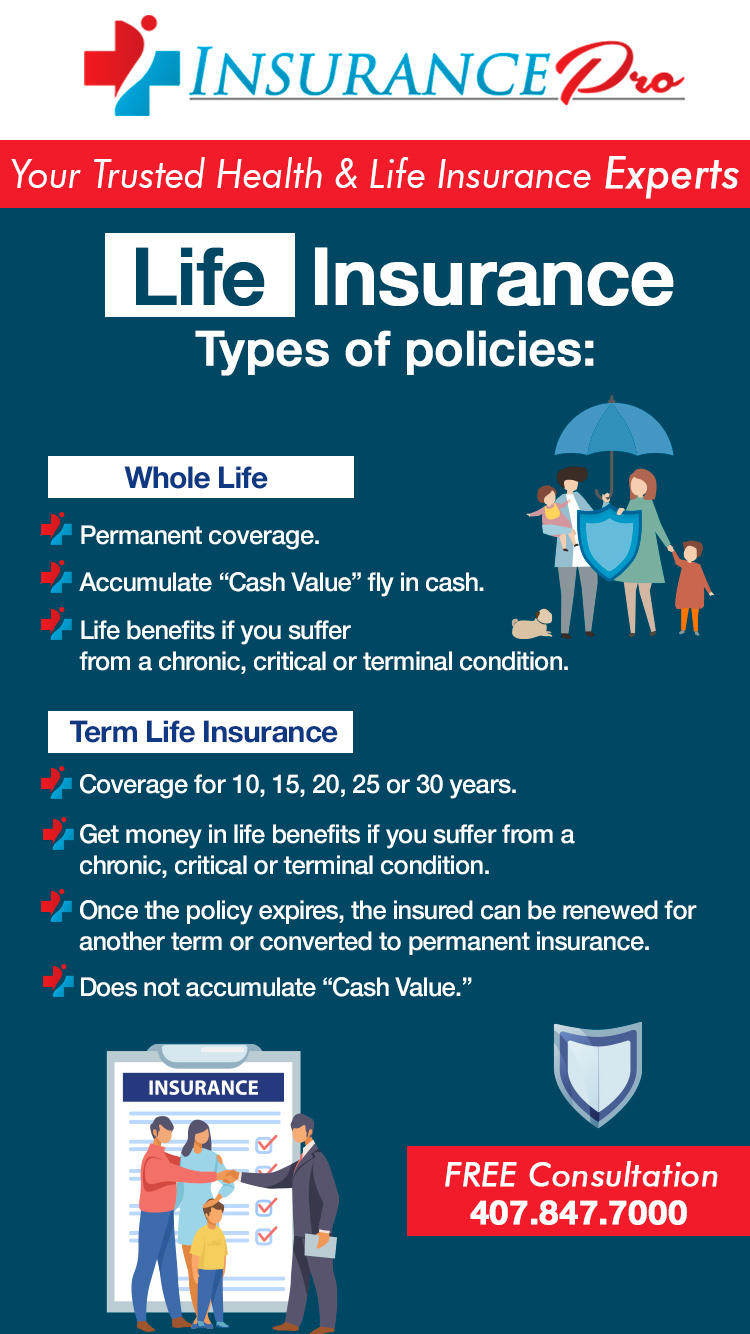

Here are a couple of factors why term life insurance is the most popular type. The price of term life insurance premiums is established based on your age, wellness, and the insurance coverage quantity you require.

HMO plans have lower month-to-month costs as well as reduced out-of-pocket expenses. With PPO strategies, you pay greater monthly costs for the liberty to utilize both in-network and out-of-network providers without a reference. PPO plans can lead to greater out-of-pocket clinical costs. Paying a costs is similar to making a monthly vehicle repayment.

Some Known Incorrect Statements About Home Insurance In Dallas Tx

When you have a deductible, you are in charge of paying a particular amount for coverage solutions prior to your health and wellness strategy provides protection. Life insurance coverage can be separated into 2 main types: term and also long-term. Term life insurance coverage gives insurance coverage for a specific period, commonly 10 to thirty years, and is much more affordable.We can not protect against the unexpected from taking place, but sometimes we can protect ourselves as well as our families from the most awful of the financial results. Picking the right type and also quantity of insurance policy is based on your particular scenario, such as youngsters, age, way of living, and also work advantages. Four types of insurance that the majority of economists recommend consist of life, health, auto, and also lasting handicap.

It includes a fatality advantage as well as additionally a cash money value part.

2% of the American population lacked insurance policy coverage in 2021, the Centers for Illness Control (CDC) reported in its National Center for Health Statistics. Greater than 60% got their coverage through a company or in the exclusive insurance policy marketplace while the rest were covered by government-subsidized programs consisting of Medicare and also Medicaid, veterans' advantages programs, and the federal industry established under the Affordable Care Act.

Not known Facts About Home Insurance In Dallas Tx

According to the Social Safety and security Management, one in 4 workers going into the workforce will become handicapped before they Recommended Site reach the age of retirement. While health and wellness insurance policy pays for hospitalization as well as medical bills, you are commonly strained with all of the expenses that your paycheck had actually covered.

Mostly all states need motorists to have auto insurance and minority that do not still hold chauffeurs economically get more responsible for any kind of damage or injuries they cause. Right here are your choices when purchasing automobile insurance coverage: Obligation coverage: Spends for home damage and also injuries you cause to others if you're at mistake for an accident and also covers litigation costs and also judgments or settlements if you're sued as a result of a vehicle crash.

Employer protection is frequently the most effective choice, but if that is inaccessible, obtain quotes from several suppliers as several supply discounts if you purchase greater than one kind of insurance coverage.

About Home Insurance In Dallas Tx

, as well as how much you want to pay for it., their pros as well as disadvantages, just how long they last, and also who they're best for.

This is one of the most prominent sort of life insurance policy for most individuals because it's budget-friendly, only lasts for as lengthy as you need it, and also features few tax regulations and constraints. Term life insurance policy is just one of the easiest and most inexpensive ways to helpful site supply a monetary safety net for your enjoyed ones.

You pay costs towards the plan, and also if you die throughout the term, the insurance provider pays a set amount of money, referred to as the death advantage, to your designated beneficiaries. The fatality benefit can be paid out as a lump amount or an annuity. Most individuals pick to get the death advantage as a round figure to avoid paying taxes on any type of earned interest. Life insurance in Dallas TX.

Report this wiki page